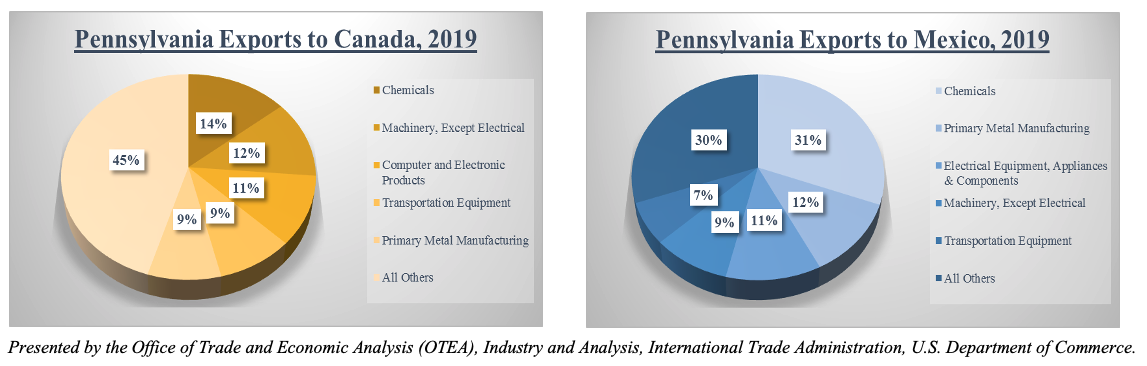

Companies in Pennsylvania compete and win in international markets across the globe and that success can be seen in the fact that Pennsylvania is the 10th largest exporting state in the U.S., with more than $42 billion in exports. For Pennsylvanian companies, no two markets are more important, overall, than Canada and Mexico. With exports to Canada and Mexico valued at more than $11 and $4 billion respectively, a third of all Pennsylvanian exports go to these two markets. This highlights why the recent implementation of the United States-Mexico-Canada Agreement, or USMCA for short, is significant for Pennsylvanian companies.

The following charts display exports from Pennsylvania to Canada and Mexico in 2019:

The USMCA went into effect on July 1, 2020 and was the result of almost three years of negotiations between United States, Mexico, and Canada in an effort to update the North American Free Trade Agreement, NAFTA for short. In the 24 plus years since NAFTA went into effect, the commercial landscapes of the three countries have changed as industries have evolved and new industries have emerged, raising new concerns and challenges that necessitated a modernization of NAFTA to the USMCA. One sector, which has evolved from a nascent sector to an important sector in Pennsylvania is Digital Trade. (Think software and apps, along with e-books, music, videos or any other digitally encoded products.) Under the USMCA, Digital Trade is expressly addressed in its own chapter, Chapter 19, and one of the most important protections the USMCA provides related to digital trade is that the USMCA prohibits the application of customs duties and other discriminatory measures on digital products distributed electronically. In an effort to enhance and protect the global digital ecosystem,the USMCA also protects against forced disclosure of proprietary computer source code and algorithms as well as addressing issues related to data localization measures used to restrict where data can be stored and processed.

The USMCA also recognizes how important protecting intellectual property rights is to developing innovation, new technology, and maintaining open markets. A few highlights from Chapter 20, Intellectual Property Rights: companies will benefit from full national treatment for copyright and related rights. The USMCA also provides strong civil and criminal trade secret protections, including against misappropriation by state-owned enterprises, and strong due process and transparency requirements for geographical indications protection systems. Under the agreement, there is also a minimum 15-year protection for industrial designs that will help Pennsylvanian companies protect their inventions. In all, the USMCA sets the highest standard of any U.S. trade agreement for protecting and enforcing intellectual property rights.

Beyond the broad-ranging, “big” issues, such as Intellectual Property, Digital Trade, and others, the USMCA also benefits small business in a number of ways. First, all products that had zero tariff rates under NAFTA will continue to have zero tariff rates under USMCA, helping Pennsylvanian products be more competitive in Mexico and Canada. For Pennsylvanian small businesses, especially those selling directly to consumers, the USMCA raises the de minimis levels for Canada and Mexico. The de minimis level for Canada is now C$40 exempt from duties and taxes, which is double from C$20 under NAFTA. For Mexico, the de minimis is US$50 exempt from duties and taxes. With the increase in the de minimis values, small businesses in Pennsylvania will see less red tape and easier shipments to their consumers in Mexico and Canada. Speaking of less red tape, gone are the days of completing, filing, and maintaining NAFTA Certificates of Origin. Unlike NAFTA, the USMCA does not have a specific certificate origin and instead, the agreement outlines a required minimum set of data elements that substantiate that the product meets the specific rules of origin to claim preferential treatment. The data elements can be included in an invoice or in a separate document, so long as the data elements are complete and provide sufficient details to enable the goods identification. Additionally, under the USMCA, it’s the importer that has the bulk of the compliance requirements. Having said that, though, Pennsylvanian companies will still need to correctly classify their products, determine and apply the appropriate rule of origin, and make the correct preference claim to support the importer’s claim that the product or products qualify for preferential treatment.

For companies looking to explore how the USMCA can benefit their efforts to increase sales to Canada and Mexico or how to comply with USMCA requirement there are a number of resources available. For an overview of USMCA and how it improves upon NAFTA, visit https://www.trade.gov/usmca. For specific requirements and how to comply with the USMCA, visit https://ustr.gov/trade-agreements/free-trade-agreements/united-states-mexico-canada-agreement/agreement-between.

Of course, you can always reach out to the Pittsburgh office of the U.S. Commercial Service, whether it’s to find opportunities in Canada and Mexico or with USMCA questions, at office.pittsburgh@trade.gov or by calling 412-644-2800.