Business & Nonprofit Leaders Express Confidence About Future of Manufacturing

Todd Miller

With the fast pace of technological advances, the uncertainties of trade policy, a shortage of qualified workers and statistical evidence of a slowdown during the third and fourth quarters of last year, one would think that a wave of pessimism would be gripping the Pittsburgh region’s manufacturing sector. Fortunately, optimism prevails in many quarters.

Linda Froehlich, Co-President of Ace Wire Spring & Form Co. in McKees Rocks, a woman-owned and veteran-owned company, exemplifi es this upbeat attitude. “We make things that are always needed,” says Froehlich, whose father founded the company in 1939. She and her husband, Rich, purchased the business in 1976 and expanded the facilities in 1986 and again in 1991.

Linda Froehlich, Co-President of Ace Wire Spring & Form Co. in McKees Rocks, a woman-owned and veteran-owned company, exemplifi es this upbeat attitude. “We make things that are always needed,” says Froehlich, whose father founded the company in 1939. She and her husband, Rich, purchased the business in 1976 and expanded the facilities in 1986 and again in 1991.

“Over the past few years, companies in our target markets have increased their reliance on domestic suppliers,” says Froehlich. “It gives them more control over quality and delivery times, and that trend has helped us. Because we are a family owned-business, customers appreciate the personalized attention we provide, and that many larger companies can’t.”

Another thing the ISO-certified, ITAR-registered company does well is solve customers’ problems. “That’s because we ask questions where others don’t,” Froehlich says. “Most companies are interested in making a quick sale, but we care about relieving pain. That may mean not making a sale immediately, but it’s the approach that’s worked well for us.

“Over the past few years, companies in our target markets have increased their reliance on domestic suppliers,” says Froehlich. “It gives them more control over quality and delivery times, and that trend has helped us."

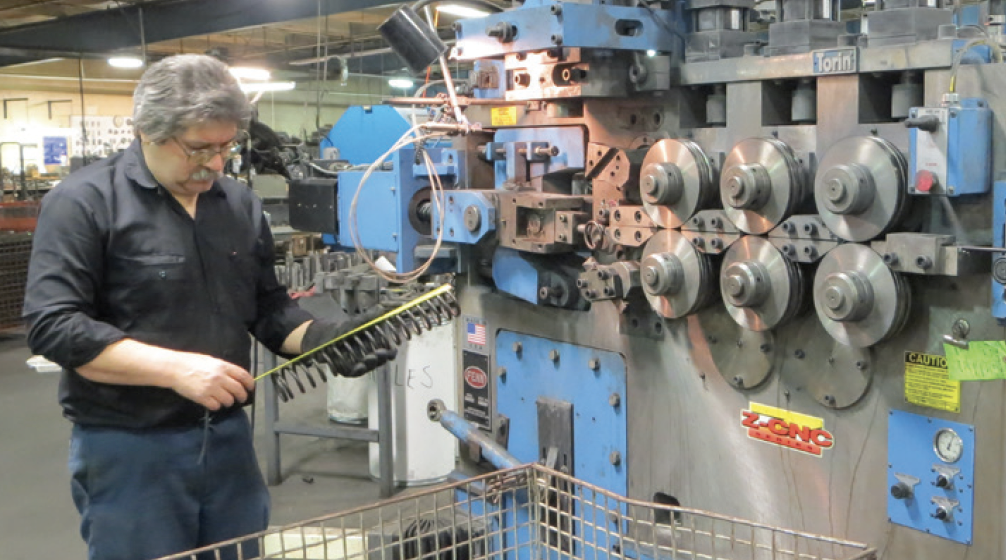

In that vein, some of the company’s biggest customers are its competitors. That’s because competitors are unable or unwilling to do the tough jobs with tight indexes or don’t have the equipment or experienced technicians to perform those operations. As a manufacturer that specializes in cold winding, Ace Wire Spring can manufacture custom precision springs and wire forms from .003” to .625” wire diameters and performs all operations in-house except for powder coating, plating and painting.

Much of the company’s business comes from its national network of manufacturers’ representatives, attendance at various trade shows such as Design2Part, AmCon and The  Shot Show, as well as from LinkedIn contacts and the company’s newly updated website which is mobile friendly. Froehlich attributes those results to being ahead of competitors with respect to having an online presence and credits growth to the desire of her nearly 50 team members to ask questions and do whatever it takes to solve problems for customers.

Shot Show, as well as from LinkedIn contacts and the company’s newly updated website which is mobile friendly. Froehlich attributes those results to being ahead of competitors with respect to having an online presence and credits growth to the desire of her nearly 50 team members to ask questions and do whatever it takes to solve problems for customers.

Ace Wire Spring & Form Co. has benefi tted from the Pittsburgh’s transformation to a center of innovation for robotics and other advanced manufacturing technologies. The company works closely with Catalyst Connection to help improve its operating effi ciency, as well as with robotics experts at the Advanced Robotics for Manufacturing (ARM) collaborative to fi nd the right partners to automate some of its processes that were previously performed manually.

The company already has a robot on its shop fl oor that picks hooks out of a bin and places them into a press. Pittsburgh-based CapSen Robotics provides the robot with the necessary spatial intelligence to manage the process with a solution that includes 3D vision software, and full motion planning and control.

To help ensure a strong workforce in the future, Froehlich and her team support the BotsIQ educational robotics competition for high school students, work with the Community College of Allegheny County to help students understand employment opportunities available to them and have also reached out to several local high schools and technical schools.

“With technology moving so quickly, we need a diff erent caliber of employee than we used to,” says Froehlich. “That’s why we need to make young people aware that manufacturing has changed since their parents and grandparents chose career paths, and that working in a manufacturing environment off ers endless career opportunities and rewards.”

HOPEFULNESS ECHOED

Despite the challenges faced by many companies to fi nd qualifi ed workers and maintain or expand their markets, Petra Mitchell, President and CEO of Catalyst Connection, is bullish on the future. The not-for-profit organization she heads provides consulting and training services to small manufacturers in southwestern Pennsylvania.

“Compared to several years ago, we’re being asked to undertake larger scale projects,” says Mitchell. “Companies are being aggressive about investing in technology by upgrading their software, especially ERP. They’re also investing in robotics, automation and workforce development because they see them as keys to being competitive in the future.”

She also notes that many of the large-scale IT projects in the region are using local companies rather than bringing in vendors from outside the area, as was the generally case until the past few years.

She also notes that many of the large-scale IT projects in the region are using local companies rather than bringing in vendors from outside the area, as was the generally case until the past few years.

Additionally, Mitchell has noticed that an increasing number of the companies her organization serves are forming partnerships with high schools and community colleges to help students understand that careers in manufacturing can be fulfi lling in every way. She has also noticed that companies in the technology and manufacturing sectors are communicating more frequently with one another and are forming business relationships or are in the process of doing so.

“With the excellent outreach eff orts so many companies have undertaken, I believe we are going to see the 2% annual growth in manufacturing employment we said was necessary for ongoing vitality in the regional economy in the Manufacturing Employment Demand Study we conducted in 2018.”

Even if annual growth in manufacturing employment falls short of projections, Mitchell believes that the region can weather any storms because of its fl exibility. “We’re no longer tied to the steel industry or any other single industry. Such diversifi cation makes us less vulnerable to downturns than many communities in the South, for example, that have tied their fortunes to the automotive industry.”

Mitchell pointed out that the petrochemical industry, with the Shell Ethane Cracker Plant in Beaver Country coming online within the next couple of years, is likely to create more opportunities for western Pennsylvania manufacturers, as well as attract other manufacturers and service businesses to the region.

STARTUPS CONTINUE TO ADVANCE

With growing connectivity of equipment on the shop fl oor (IoT – the internet of things), the emergence of 3D printing and increased customization, AlphaLab Gear, a program of North Side-based Innovation Works, the Ben Franklin Technology Partner of southwestern Pennsylvania, is experiencing high demand for its services. The hardware accelerator, based in Pittsburgh’s East Liberty neighborhood, invests $25,000-$50,000 in startup manufacturing companies when they join the program and provides them with consulting services. The fi nancial and advisory assistance that AlphaLab Gear off ers enables companies to prototype and scale their inventions over a 30-week period at prices customers are willing to pay. At the end of the program, AlphaLab Gear may invest up to $50,000 more, depending upon the company’s progress.

“Increasing demand for customization, and for smaller batch items at reasonable prices, are trends that characterize manufacturing now and will become more prevalent in the years ahead, regardless of how the economy performs,” says Ilana Diamond, AlphaLab Gear’s Managing Director. “The assistance we provide makes companies more attractive to investors.”

AlphaLab Gear’s support of manufacturing startups has also built bridges to the Pittsburgh region’s corporate community. “Many established companies have become interested in partnering with startups because they can benefi t from innovation quickly without investing signifi cant resources in R&D,” Diamond explains. “This dynamic is mutually benefi cial as startups can secure a steady source of income in their early stages of development.”

She cites the example of Bosch, the Germany-based engineering and technology conglomerate, whose Chris Martin directs the company’s Research and Technology Center in Pittsburgh. Under Martin’s leadership, Bosch regularly taps into the knowledge, products and solutions that AlphaLab Gear companies generate so that Bosch can innovate faster than it could otherwise in developing hardware and software, consumer goods and industrial technology.

Additionally, Diamond cites Maven Machines as another example of a company that has benefi tted from Pittsburgh’s technology and corporate communities. The company, which relocated from Boston to participate in AlphaLab Gear and put down roots in Pittsburgh after the program ended, develops fl eet management and dispatching solutions for transportation companies. Suppliers from the region’s manufacturing and technology sectors, and employees from area universities, have helped the company grow.

ROBOBURGH INDEED

Another organization that is helping to keep manufacturing in the Pittsburgh region strong despite recent headwinds is Advanced Robotics for Manufacturing (ARM). The Hazelwood-based, 200-plus-member organization is one of 14 manufacturing institutes under the umbrella of Manufacturing USA and is funded jointly by government and private industry to work on research projects of 6-12 months in duration. Members can use project output for internal purposes. It can also be licensed for commercial use.

Other institutes include Advanced Functional Fabrics of America (clothing fi ber transformation; Cambridge, MA), America Makes (3D printing; Youngstown, OH) and LIFE  (Lightweight Innovations for Tomorrow; Detroit).

(Lightweight Innovations for Tomorrow; Detroit).

ARM members range from large global manufacturers such as Air-bus, Intel and Siemens to medium-sized manufacturers, universities, community colleges and trade schools. The organization used to share space with the National Robotics Engineering Center in Lawrenceville and now has a high bay facility in the 30,000 squarefoot space at Hazelwood Green it has occupied since July of last year.

“As a result of our recent move, we can do testing and prototyping to whatever extent is necessary,” says Suzy Teele, ARM’s Head of Marketing and Communications.

While concentrating on R&D, ARM is also doing its part to help develop the workforce of tomorrow by investing in workforce development programs that focus in areas such as apprenticeship programs, online micro-credentialing and helping the underserved obtain employment in manufacturing jobs.

WHAT’S AHEAD?

Amid the favorable conditions described, Pennsylvania lost more than 8,000 manufacturing jobs in the fi rst three quarters of 2019. That contrast is largely the result of big companies such as U.S. Steel and Kennametal reducing their workforces. At the same time, Pittsburgh-area tech firms, many of which are vital customers of and suppliers to manufacturers, raised more than $205 million in venture capital, a 30 percent increase from the previous year.

Time will tell whether employment levels at mid-sized and smaller manufacturers, and in tech companies, can off set job losses at larger companies. The smart money would bet “yes.”