RSM News Roundup

Submitted by RSM

RSM Attack Vector Report 2024

With breaches on the rise in the middle market, creating an effective cybersecurity strategy is imperative to protect sensitive data and intellectual property, comply with evolving regulatory demands and even sustain operations. Gaining insight into the cybersecurity challenges and vulnerabilities peer organizations face can provide a critical head start to developing a practical cybersecurity stance and focusing energy on areas that may be at risk.

Discover critical insights into cybersecurity threats with RSM US LLP's annual Attack Vector Report. Our report draws from a robust internal database of penetration tests and offers a unique perspective on the evolving tactics of threat actors. Despite using recurring attack patterns, the digital threat landscape is in constant flux, with adversaries continually adapting to outmaneuver security measures.

Our methodology is meticulous: we analyze data from organizations that have undergone both penetration testing and a NIST Cybersecurity Framework assessment with RSM. By examining risk ratings, levels of compromise and attack vectors against NIST CSF maturity levels, we uncover trends and critical observations. This year's report is enriched with historical data, providing a comprehensive view of the current threat environment. With a special focus on internal attack vectors—now more prevalent than external ones—we offer insights that can bolster your organization's defenses.

Don't wait for a breach to learn the importance of cybersecurity; take action now. Secure your copy of the report and empower your team with the knowledge to stay one step ahead of cyberthreats.

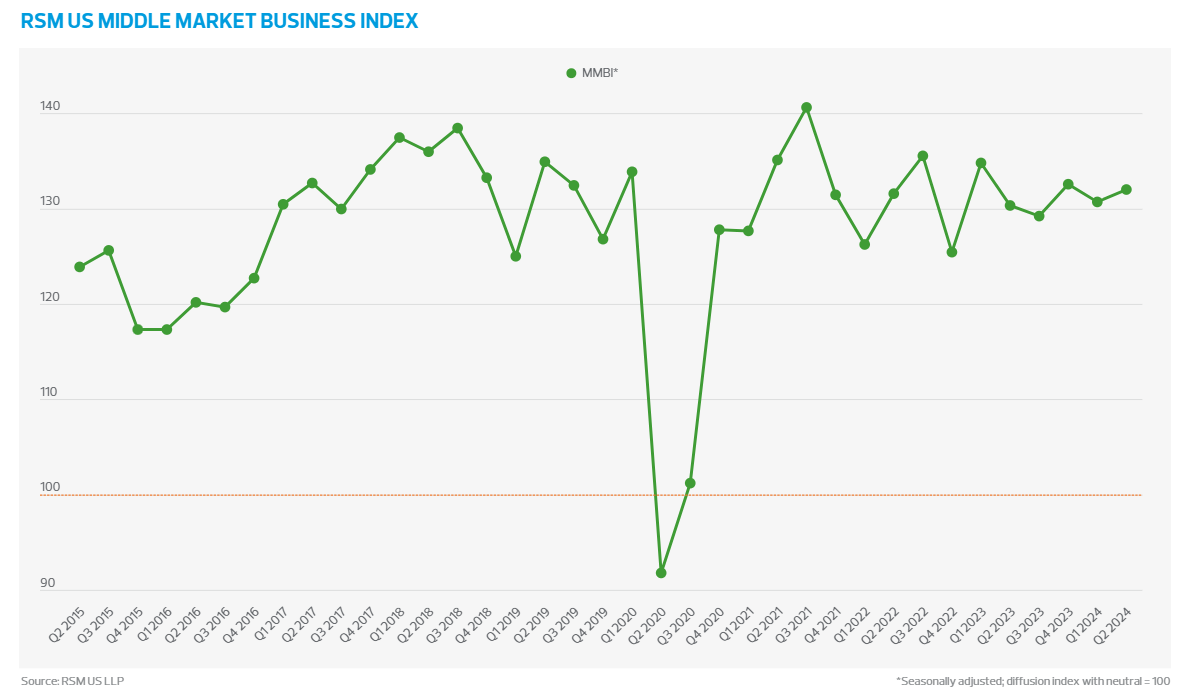

Q2 2024 RSM US Middle Market Business Index

A sustained business expansion characterized by historically low unemployment, strong household consumption and robust business revenues continued to provide a tailwind for the American real economy in the second quarter.

The proprietary RSM US Middle Market Business Index rose to 132.0 in the quarter from 130.7 in the prior period. Since rebounding from the trough of the pandemic, the index has moved in a range of 125.5 to 140.7, which compares favorably to the pre-pandemic range of 117.3 to 138.4. The survey’s high, posted in the third quarter of 2021 as the economy snapped back from the pandemic shutdown, was 140.7.

Despite the modest improvement in confidence in the second quarter, 40% of executives surveyed indicated that the economy had improved; 32%, by contrast, said conditions had deteriorated.

In our estimation, the long tail of the pandemic and the ensuing price shock has taken a powerful toll on smaller firms, which continue to face a challenging environment of higher wages and input costs.

Inside the MMBI report

The financial performance for middle market firms remained strong in the second quarter, the survey found. An improvement in net earnings and revenues led a majority of executives to report that they intended to boost productivity-enhancing capital expenditures over the next six months. Starting from Q4 2020, this was the 15th consecutive MMBI survey that found such an intent.

Companies’ willingness to invest is helping fuel a productivity boom that is currently working its way through the American economy. If it continues, this will lead to a virtuous cycle of improved growth, low unemployment and price stability.

Nearly half of respondents, or 47%, indicated that gross revenues had improved, while 45% said that net earnings increased. Far fewer, 25% and 26% respectively, said that revenues and earnings had deteriorated. Looking ahead, 68% of survey participants said they expect gross revenues to improve over the next six months, and 61% said the same about net earnings.

This is most likely a big reason why 53% of respondents indicated they expect the general economy to improve. While we remain confident in the direction of middle market capital expenditures, 65% of executives indicated a real and abiding concern about the cost of capital.

That concern puts more focus on upcoming decisions by the Federal Reserve on its policy rate—we forecast two rate cuts of 25 basis points each this year, starting in September. The Fed’s decisions will largely shape the duration and intensity of the current business expansion.

Approximately 24% of MMBI respondents indicated that they expect rates to remain unchanged over the next year; 54% expect rates to increase; and 22% anticipate a decrease.

Employment and compensation

Overall hiring levels remained constant in the second quarter, with 44% of executives saying they had increased hiring, unchanged from the previous quarter.

At the same time, 17% said they had slowed hiring. We expect hiring to slow somewhat, to a more sustainable pace, in the second half of the year as economic growth eases to a 2.4% average pace for the full year.

But a tight labor market has caused firms to offer greater compensation to attract and retain talent. Over 8 million job openings remain unfilled, which translates to 1.3 job openings for every unemployed worker. About three-quarters, or 74%, of executives in the MMBI survey indicated that they are significantly or somewhat concerned about access to skilled labor; 75% said the same about the cost of labor.

It’s no surprise, then, that 57% of executives said they had increased compensation in the second quarter and 61% expect to do so in the second half of the year.

Prices paid and prices received

Over the past four quarters, prices paid have stabilized, with an average of 71% of executives stating they had paid higher prices, roughly the same percentage who said they had done so in the current quarter.

Just as important, 67% of respondents said they expect to pay more for goods and services over the final six months of the year.

In terms of the percentage of executives who are reporting increases for prices received for goods and services for this quarter and the next six months, 52% said they had passed along higher costs in the second quarter and 62% said they intend to do so in the coming months.

This is another sign that prices have stabilized, albeit at higher levels, and suggests that midsize organizations have made the adjustment to a higher post-pandemic-era level of prices.

Borrowing and inventories

Access to capital necessary for expansion improved significantly in the second quarter, with 29% of firms indicating that borrowing had become less tight, up from 20% earlier in the year.

Looking ahead, however, executives in the survey expressed doubt about their ability to borrow over the next six months; only 32% expected easier access to capital, down from 43% in the first quarter. That figure was consistent with findings in the Federal Reserve’s survey of senior loan officers in the first quarter.

We expect that the middle market outlook on borrowing is tied to uncertainty over when persistently high lending rates will come down.

Federal Reserve Chairman Jerome Powell signaled in May that it may be some time before the Fed is prepared to reduce the benchmark federal funds rate it has held steady at a two-decade-high in the range of 5.25% to 5.5% since last July.

Firms continue to manage inventory accumulation carefully, with only 40% of respondents implying that they increased stocks, and 51% saying that they intend to do so over the next six months.

This is most likely due to middle market businesses’ attempts to avoid getting too far ahead of consumer demand amid high interest rates, even as inflation continues to cool ahead of the always-critical holiday shopping season.